Let’s say you fill a prescription for metformin and your insurance copay is $45. Then you check GoodRx and see the same 90-day supply for $12 at the pharmacy down the street. You’re saving over $30 - that’s a no-brainer, right? But what if you’re on Medicare and that coupon doesn’t work at all? Or what if you’re trying to save on a brand-name drug like Lyrica, and the coupon only knocks off $1.20? Prescription discount programs and coupons can save you serious money - but only if you know how, when, and where to use them.

How These Programs Actually Work

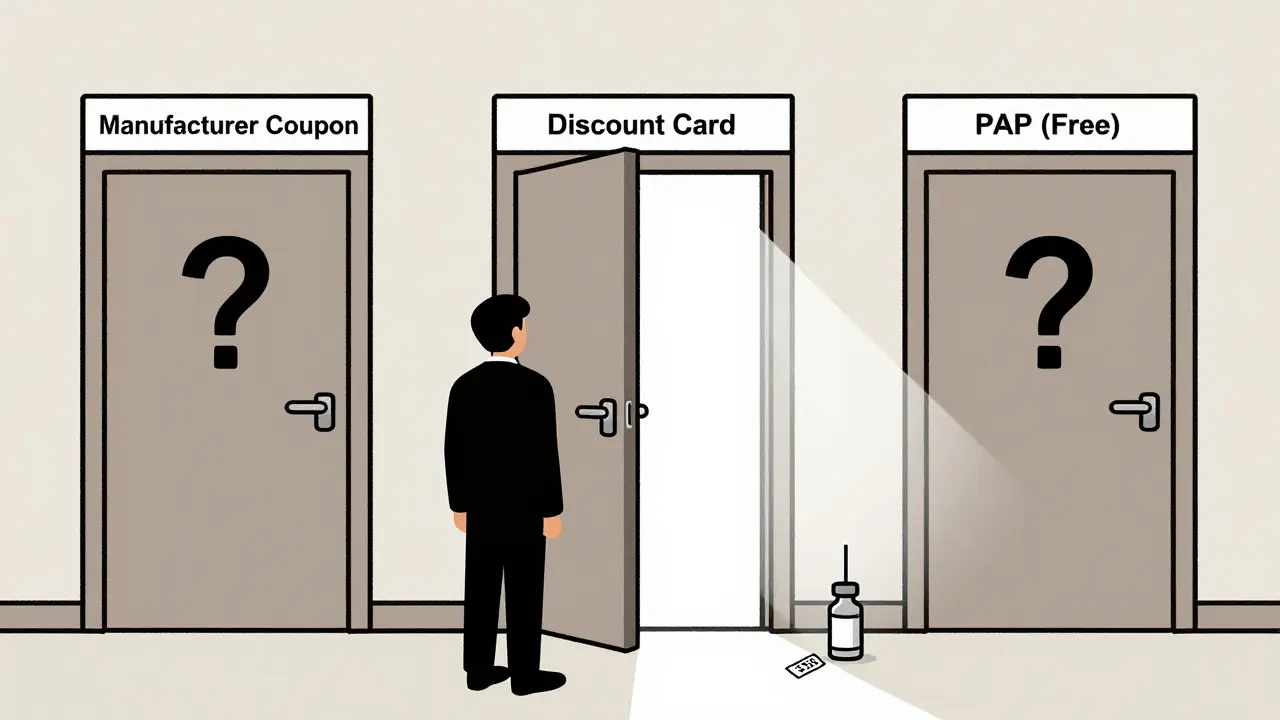

There are three main types of prescription discount tools out there, and they don’t all work the same way.Manufacturer coupons come straight from the drug company. You sign up on their website, print or download a code, and show it at the pharmacy. These are mostly for brand-name drugs - think insulin, asthma inhalers, or cholesterol meds. They reduce your copay, but here’s the catch: they don’t lower the list price. The drug still costs the system the same amount. In fact, research shows these coupons can actually push people away from cheaper generics, even when they’re just as effective.

Third-party discount cards like GoodRx, Blink Health, and SingleCare are different. They don’t come from drugmakers. Instead, they negotiate cash prices directly with pharmacies. You enter your drug name and zip code, and it shows you the lowest price nearby. These work best for generics. One 2022 study found that for a common 3-drug generic combo, these cards cut prices from $52.80 down to $18.60. That’s a 65% drop. For brand-name drugs? Not so much. The same study showed savings of just 6.8% to 11.7% - barely enough to bother with.

Prescription Assistance Programs (PAPs) are run by nonprofits or clinics. They’re for people with no insurance or very low income. You apply, prove your financial need, and if approved, you get the medication for free. One free clinic in Tennessee helped 61 patients get 23 different drugs over 13 months and saved them a total of $222,563 - that’s nearly $3,650 per person. These aren’t for everyone, but for those who qualify, they’re the most powerful tool of all.

Who Saves the Most - and Who Gets Left Out

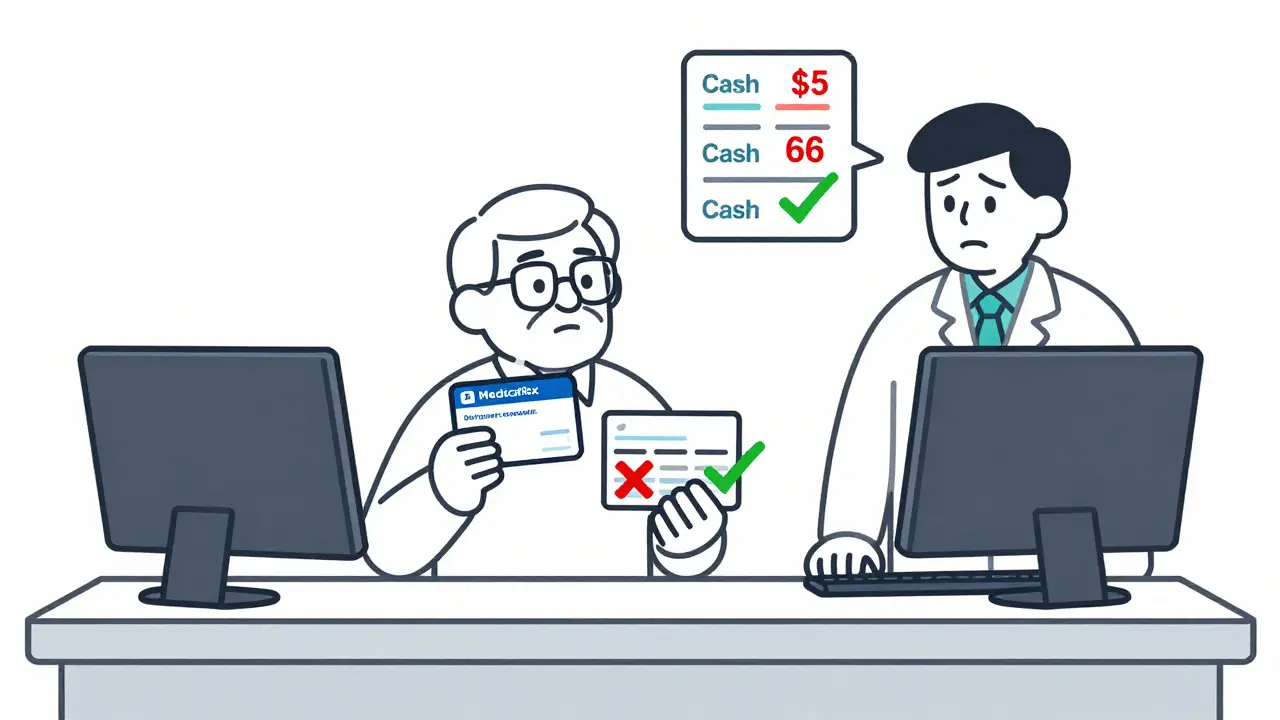

Not everyone benefits equally. The biggest winners? People buying generic drugs without good insurance. A 2024 study in JAMA Network Open found that coupons cut out-of-pocket costs by nearly 85% for those using them. But that number drops fast if you’re on Medicare.Medicare Part D doesn’t allow you to stack manufacturer coupons with your plan’s coverage. That means if you’re on a plan that already gives you a low copay, a coupon might not help at all. Worse - some plans won’t let you use a discount card at all if it’s cheaper than your copay. You’re stuck paying the higher insurance price.

Seniors are the biggest users of discount cards - 42% of users are on Medicare. And here’s the irony: nearly half of them save more than $5 per prescription using a card instead of their plan. But 42% also say they’re confused about when to use the card versus their insurance. That confusion costs people money.

Meanwhile, people on brand-name drugs get the short end of the stick. Even with a coupon, you might only save a few dollars. A user on Reddit saved $47 on metformin with GoodRx - but another saved just $1.20 on Lyrica. That’s not a discount. That’s a rounding error.

The Hidden Costs: Who Pays When You Save?

It’s easy to think of these programs as pure wins. But there’s a ripple effect.Manufacturer coupons are designed to keep people on expensive brand-name drugs. A 2024 study found that when coupons are available, brand-name drug use goes up by 60% - and generic use drops. That’s bad for the whole system. The Congressional Budget Office estimates these coupons could add $2.7 billion a year to Medicare spending by steering people away from cheaper alternatives.

Pharmacies and insurers don’t like this. They’ve built formularies - lists of preferred drugs - to keep costs down. Coupons mess with that. The American Medical Association warns they undermine clinical decisions. If your doctor prescribes a generic because it’s just as good, but you use a coupon to get the brand, you’re not just saving money - you’re changing how care is delivered.

And then there’s the price chaos. One pharmacy might offer a $10 price for a drug. The next one, two blocks away, charges $35. GoodRx shows both. But pharmacists often don’t know how to process these cards. One in three users report staff confusion at the counter. That means you might wait 15 minutes while they figure it out - or just give up and pay full price.

Real-World Savings: What People Are Actually Paying

Let’s look at real numbers from real people.- A 68-year-old on Medicare used GoodRx for lisinopril - a generic blood pressure pill - and paid $7 instead of their $22 copay. Saved $15 per month.

- A 45-year-old with private insurance tried a coupon for their brand-name antidepressant. It cut their $60 copay to $45. Still expensive. They switched to a generic and paid $10.

- A patient with no insurance needed insulin. The cash price was $350. Through a PAP, they got it free.

- A couple used a discount card for their child’s ADHD medication. The card showed $18. The pharmacy charged $42. They paid $42 because the card didn’t work with their insurance.

Trustpilot reviews for GoodRx show a 4.3/5 rating. People love the app. They love the savings on generics. But the negative reviews are loud: 37% complain about inconsistent pricing. 29% say brand-name savings are useless. And 28% say pharmacists don’t know how to use the codes.

How to Use These Programs Without Getting Screwed

If you want to save money, here’s how to do it right:- Check your insurance first. Call your pharmacy and ask what your copay is. Don’t assume it’s the lowest price.

- Compare with GoodRx or SingleCare. Enter your drug name and zip code. If the cash price is lower than your copay, use the card. If it’s higher, stick with insurance.

- For brand-name drugs, skip the coupon. Ask your doctor if there’s a generic alternative. If not, check if the manufacturer has a PAP - not a coupon. PAPs give you the drug free. Coupons just lower the copay.

- For Medicare users, never use a manufacturer coupon. It won’t work. Use a discount card only if it’s cheaper than your plan’s price.

- Always ask the pharmacist. Say: “I have a discount card. Can you process it?” If they say no, ask for the manager. Many don’t know how to handle them.

- Look for PAPs if you’re uninsured or low-income. NeedyMeds.org has a free database of programs for almost every drug. Fill out the application. It takes time, but it’s worth it.

What’s Changing in 2026 - And What It Means for You

The rules are shifting fast. Starting in 2025, the Inflation Reduction Act caps out-of-pocket drug costs for Medicare Part D users at $2,000 a year. That’s a game-changer. If you’re on Medicare and take multiple expensive drugs, you might not need discount cards anymore.At the same time, the FTC is investigating whether manufacturer coupons are anti-competitive. If they’re found to inflate prices, they could be restricted or banned.

And new tools are coming. Some pharmacy chains are testing AI apps that look at your insurance plan and your discount card options at the same time. They tell you: “Use your insurance here. Use GoodRx there.” That’s the future - programs that work with your plan, not against it.

For now, the best strategy is simple: know your drug, know your plan, and always check both. A coupon isn’t always a deal. A discount card isn’t always better. But if you do the math, you’ll almost always save something - and sometimes, you’ll save a lot.

Can I use a prescription coupon with my Medicare Part D plan?

No, you cannot use manufacturer coupons with Medicare Part D. These coupons are designed to reduce your copay, but Medicare rules don’t allow them to be combined with your plan’s coverage. Even if the coupon looks like it lowers your price, the pharmacy won’t be able to apply it. You can, however, use third-party discount cards like GoodRx - but only if the cash price is lower than your plan’s negotiated rate.

Do discount cards work on brand-name drugs?

Sometimes, but rarely enough to matter. Third-party discount cards like GoodRx typically offer only 6.8% to 11.7% savings on brand-name drugs. For example, a $1,300 prescription might drop to $1,212 - still over $1,200 out of pocket. Manufacturer coupons offer slightly better savings on brand drugs, but they don’t work with Medicare and can push you away from cheaper generics. If you’re on a brand-name drug, your best move is to ask your doctor about a generic alternative.

Why is the price different at every pharmacy?

Pharmacies set their own cash prices for drugs, and they’re not required to be transparent. A big chain might charge $50 for a generic, while an independent pharmacy down the street charges $12. Discount card apps like GoodRx show you the lowest price nearby, but that price can change daily. Also, some pharmacies don’t honor discount cards consistently - staff might not know how to process them, or the system might glitch. Always call ahead or ask the pharmacist to verify the price before you pay.

Are prescription discount programs safe?

Yes, the programs themselves are safe. GoodRx, SingleCare, and NeedyMeds are legitimate, well-established services. The medications you receive are the same ones your doctor prescribed. The risk isn’t in the program - it’s in the confusion. Some people use coupons for brand-name drugs when a generic would work just as well. That can lead to higher long-term costs and doesn’t always improve health outcomes. Always talk to your doctor before switching drugs, even if the price is lower.

What’s the difference between a coupon and a discount card?

A coupon comes from the drug manufacturer and reduces your copay for a specific brand-name drug. A discount card comes from a third party like GoodRx and gives you a cash price for any drug - brand or generic - by negotiating directly with pharmacies. Coupons only work on the drug they’re for. Discount cards work on almost any prescription. Coupons don’t work with Medicare. Discount cards can, if they offer a lower price than your plan.

Can I use a discount card if I have insurance?

Yes, but only if the cash price on the discount card is lower than your insurance copay. Many people assume insurance always gives the best price - but that’s not true. For generics, discount cards often beat insurance. For example, your plan might charge $25 for a 30-day supply of metformin, but GoodRx shows $8 at a nearby pharmacy. In that case, you should pay cash using the card. Never use both. Choose the lower price.

How do I find a Prescription Assistance Program (PAP)?

Go to NeedyMeds.org - it’s free and has a searchable database of over 1,000 PAPs. You can search by drug name or condition. Most programs require proof of income, a doctor’s letter, and a completed application. It can take 2-6 weeks to get approved, but if you qualify, you get the drug for free. This is the best option for uninsured patients or those with very low income who need expensive medications like insulin or cancer drugs.

Paul Ong

January 1, 2026 AT 21:50Just used GoodRx for my generic blood pressure med and paid $5 instead of $28 with insurance. No brainer. Why are people still overpaying?

Richard Thomas

January 3, 2026 AT 03:33The real issue isn't whether coupons save money-it's that the system is designed to make you think savings are simple when they're not. You're not just choosing between prices, you're choosing between a fragmented, opaque, profit-driven infrastructure and a healthcare model that pretends to care about you. The coupon is a Band-Aid on a hemorrhage. And the worst part? The people who need help the most-low-income seniors, the uninsured-are the ones who get buried under the most bureaucracy and confusion. The system doesn't want you to win. It wants you to keep trying.

Andy Heinlein

January 3, 2026 AT 13:22OMG this is so true!! I just saved $40 on my diabetes meds with SingleCare and my pharmacist was like ‘uhhh what is this?’ 😅 But then she called the manager and it worked!! Just keep asking!! Don’t give up!! 💪

Layla Anna

January 4, 2026 AT 18:59My mom is on Medicare and she used to pay $35 for her statin until she found a GoodRx deal for $11. She doesn't even know how to use the app but I helped her. Now she says she feels less stressed about meds. It's small but it matters. ❤️

gerard najera

January 5, 2026 AT 14:36Insurance is a scam. Cash prices are real prices.

Olukayode Oguntulu

January 5, 2026 AT 20:39Ah yes, the neoliberal pharmacoeconomic theater-where commodified health interventions masquerade as consumer empowerment, while the structural fissures of pharmaceutical capital remain untouched. The coupon is a rhetorical fig leaf for a system that extracts surplus value under the guise of benevolence. One must ask: who benefits when the patient becomes a price-optimizing agent? The answer, of course, is not the patient.

jaspreet sandhu

January 6, 2026 AT 02:40People in America think saving $10 on a pill is a win. In India we get insulin for $2 a vial because the government regulates prices. You think coupons are helping? You're just playing along with a rigged game. Your drug companies are laughing at you while you scroll through GoodRx like it's a game show.

Alex Warden

January 6, 2026 AT 08:11Why don't we just fix the system instead of letting people hunt for discounts like it's a treasure map? This is pathetic. We're the richest country on earth and people are choosing between insulin and groceries. Shame on us.

Heather Josey

January 7, 2026 AT 09:16Thank you for this comprehensive breakdown. Many patients are unaware of the distinctions between manufacturer coupons and third-party discount cards, and the implications for Medicare beneficiaries. I’ve shared this with my clinic’s patient education materials. Clarity in this space is not just helpful-it’s essential for equitable access.

Donna Peplinskie

January 8, 2026 AT 18:10I just want to say how much I appreciate how thoughtful this post is-it’s rare to see someone explain the nuances without oversimplifying. I’ve been helping elderly neighbors navigate this mess for years, and the confusion is heartbreaking. The fact that pharmacies often don’t know how to process discount cards? That’s not just inconvenient-it’s dangerous. Please keep sharing this kind of info. We need more of it.

LIZETH DE PACHECO

January 9, 2026 AT 12:41My sister just got approved for a PAP for her cancer med-free for 12 months. Took 6 weeks and a ton of paperwork, but it’s life-changing. If you’re struggling, don’t give up on NeedyMeds. It’s a grind, but it works. You’re not alone.

Lee M

January 11, 2026 AT 09:11Everyone’s talking about coupons like they’re magic. But the real problem is the pharmaceutical monopoly. The system is rigged. No amount of GoodRx will fix that. You’re just rearranging deck chairs on the Titanic.

Richard Thomas

January 12, 2026 AT 20:38You're right about the Titanic. But here’s the thing-when you're drowning, you grab the nearest life preserver, even if it's not the solution. The coupon isn't justice. It's survival. And if you're a senior on fixed income, survival isn't a luxury-it's the only thing you have left. The system won't fix itself. So we fix what we can, one $12 metformin at a time.