When you’re switching health plans, the biggest mistake most people make? They focus only on monthly premiums and ignore what happens when they need their pills. If you take even one regular medication - whether it’s for high blood pressure, diabetes, or thyroid issues - your generic drug coverage could save you hundreds or even thousands a year. Or it could cost you more than you expected. And no, you can’t just assume your current meds will be covered the same way under a new plan.

Why Generic Drugs Matter More Than You Think

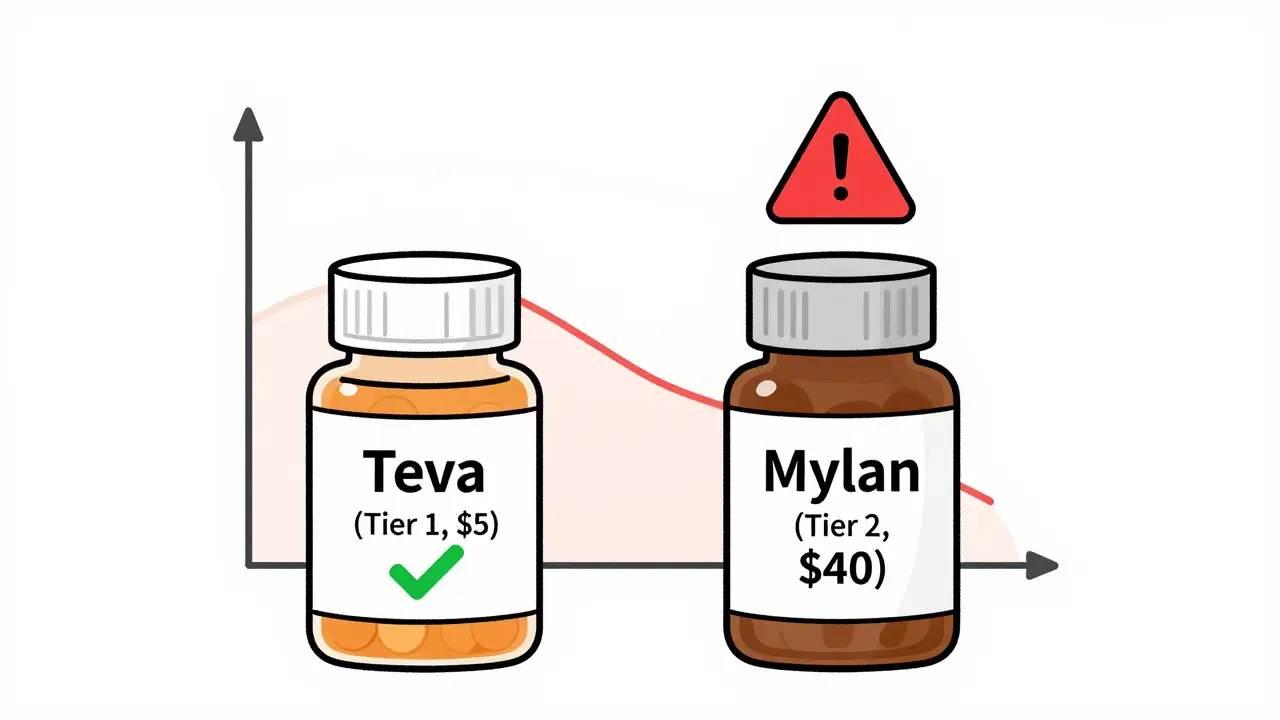

Generic drugs aren’t just cheaper versions of brand-name pills. They’re the exact same medicine, approved by the FDA, with the same active ingredients, strength, and effectiveness. But here’s the catch: insurance companies treat them differently. Most plans put generics in the lowest cost tier - Tier 1 - because they’re safe, proven, and cost-effective. In fact, generics make up 90% of all prescriptions filled in the U.S., but only 23% of total drug spending. That’s because they’re so affordable.But not all plans treat Tier 1 the same. Some charge a flat $3 copay. Others make you pay the full deductible first. And some don’t cover your specific brand of generic at all. If your plan changes the manufacturer of your metformin or levothyroxine, even if it’s still labeled "generic," you could suddenly jump from a $5 copay to $40. And you won’t know until you get to the pharmacy.

How Formularies Work - And Why They’re Confusing

Every health plan has a formulary - a list of drugs it covers, organized into tiers. The higher the tier, the more you pay. Here’s how it usually breaks down:- Tier 1: Preferred generics - cheapest, usually $3-$20 copay

- Tier 2: Non-preferred generics or brand-name drugs - $30-$60 copay

- Tier 3: Preferred brand-name drugs - $60-$100 copay

- Tier 4: Non-preferred brand-name or specialty drugs - 30-40% coinsurance

- Tier 5: High-cost specialty drugs - up to 50% coinsurance, capped at $700 per script

But here’s where it gets messy. Some plans use only 3 tiers. Others use 5. Medicare Part D plans have their own structure. And some plans, especially high-deductible ones, don’t cover any prescriptions until you’ve paid $1,500 or more out of pocket. That’s fine if you’re healthy. But if you take three generics a month at $15 each, that’s $540 a year - and if your deductible is $2,000, you pay every single cent yourself until you hit that number.

Not all plans are created equal. Silver Standardized Plans (SPDs) under the Affordable Care Act are required to waive the deductible for Tier 1 generics. That means you pay just $20 per script - no matter what your deductible is. In contrast, non-standardized plans often force you to pay the full deductible before your generics kick in. According to KFF, this difference can save low-income users up to $1,200 a year.

Medicare vs. Private Plans - What’s the Real Difference?

If you’re on Medicare, you’re likely enrolled in Part D for prescriptions. But you have two options: a standalone Part D plan or a Medicare Advantage plan with drug coverage (MA-PD). Here’s what you need to know:- Standalone Part D: Base deductible is $505 in 2023. After that, generics usually cost $0-$10 per script.

- Medicare Advantage (MA-PD): Often has lower out-of-pocket costs for generics - 18% cheaper on average than standalone plans. But coverage varies wildly by plan.

Here’s a real example: Levothyroxine, a common thyroid medication. Under Plan A, it’s a Tier 1 generic with $0 copay. Under Plan B, it’s a Tier 2 generic with 25% coinsurance. Same drug. Same manufacturer. Same active ingredient. But because Plan B doesn’t list it as "preferred," you pay $30 instead of $0. That’s not a mistake. That’s how the formulary works.

And it’s not just Medicare. Employer plans vary too. Some federal plans charge $5 for generics before the deductible. Others charge $10 after. One plan might cover your metformin 500mg, but not the 1000mg version. You need to check the exact strength.

State Rules Change Everything

Where you live matters more than you think. California has a $85 outpatient drug deductible, then 20% coinsurance capped at $250 per year. New York waives the deductible for generics and caps copays at $75 for specialty drugs. DC has a separate $350 drug deductible. And in some states, insulin is $0 with no deductible - thanks to laws like California’s SB 1423.If you’re switching plans within the same state, you might not notice the difference. But if you move - or if you’re comparing plans across state lines - those rules can make or break your budget. A plan that looks cheap in Texas might cost you $800 extra a year in California because of how coinsurance stacks.

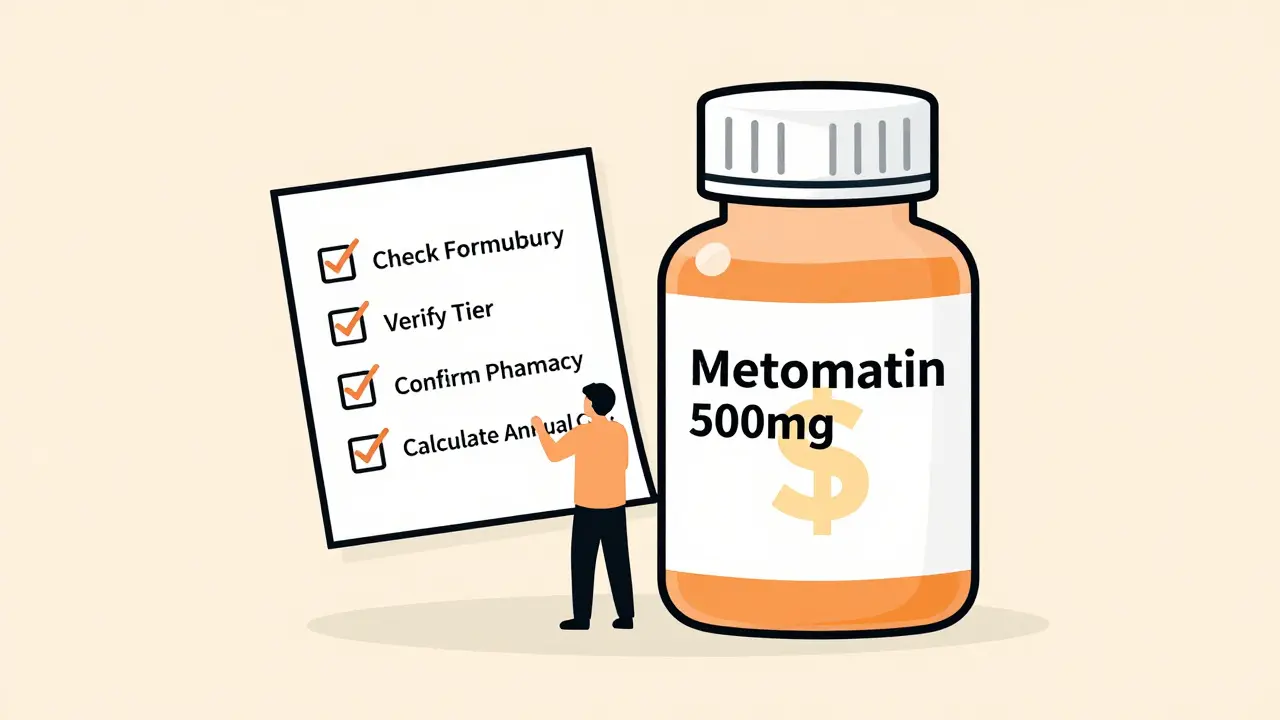

The 4-Step Checklist You Must Follow

Don’t guess. Don’t assume. Don’t wait until your script is denied. Here’s what to do:- Get the full formulary - not just the summary. Go to the insurer’s website and download the complete drug list. Look for your exact medications - name, strength, and manufacturer.

- Check the tier and cost-sharing rules. Is your drug Tier 1? What’s the copay? Is it after deductible? Is there a coinsurance? Is there a limit on how many you can get per month?

- Verify your pharmacy network. Your plan might cover your drug, but only at CVS or Walgreens. If your local pharmacy isn’t in-network, your $5 copay could jump to $20 or more.

- Calculate your annual cost. Multiply your monthly cost by 12. Add in any deductible you must meet first. Don’t forget mail-order options - they’re often cheaper for 90-day supplies.

CMS data shows people who follow all four steps reduce unexpected drug costs by 73%. That’s not a small number. That’s hundreds, maybe thousands, saved.

Tools That Actually Work

You don’t have to do this alone. Here are the best tools:- Medicare Plan Finder (medicare.gov): Best for seniors. Lets you enter your exact drugs and see total annual costs across all Part D plans. Used by over 4 million people in 2022.

- Healthcare.gov Plan Selector: For marketplace plans. Shows you how much you’ll pay for each drug under each tier. Filters by Silver SPD plans - the ones that waive deductibles for generics.

- Insurer-specific formulary tools: Most big insurers like UnitedHealthcare, Humana, and Blue Cross have their own search tools. Accuracy? Up to 96% if you use the insurer’s own site.

- eHealthInsurance’s calculator: Good for comparing multiple private plans side by side. Processes 1.7 million queries a month.

Pro tip: Never trust a third-party site like eHealth or Policygenius for exact drug costs. Always cross-check with the insurer’s official formulary. Their tools are great for narrowing options, but the final numbers? Go to the source.

Common Mistakes (And How to Avoid Them)

Here’s what goes wrong - and how to stop it:- "My drug is generic, so it’s covered." Not true. Some plans only cover generics from specific manufacturers. Switching from one generic brand to another can bump you to a higher tier.

- "I didn’t need to check because my plan covered it last year." Formularies change every January. Your $3 drug could become a $25 drug overnight.

- "I’ll just pay cash." Sometimes cash is cheaper than insurance. Check GoodRx or SingleCare. For some generics, you can pay $4 at Walmart - less than your copay.

- "I didn’t realize my mail-order pharmacy wasn’t covered." Many plans offer discounts for 90-day mail-order scripts. But if you use a non-preferred pharmacy, you pay full price.

Reddit users reported 147 cases in 2023 where people were hit with surprise costs - 63% of them were because their generic switched manufacturers. Your metformin from Teva became metformin from Mylan. Same pill. Different price. That’s the game.

What’s Changing in 2025 and Beyond

The rules are shifting fast. Starting in 2025, Medicare Part D will cap out-of-pocket drug spending at $2,000 a year. That’s huge. Also, insulin will be capped at $35 per month across all plans. And by 2027, experts predict 80% of marketplace plans will eliminate the integrated prescription deductible - meaning you won’t have to pay your medical deductible before your generic drugs kick in.But that doesn’t mean you can relax. Formularies are getting more complex. Some plans are splitting Tier 1 into two: "preferred generics" and "non-preferred generics." That means even your cheapest drugs might not be covered the same way.

The bottom line? The system is designed to make you pay more if you don’t pay attention. But if you take 30 minutes to check your drugs before switching - you’ll save more than you spend on your next coffee.

How do I know if my generic drug is covered by a new health plan?

Download the plan’s full formulary from the insurer’s website. Search for your drug by its exact name, strength (e.g., 500mg), and manufacturer (if listed). Check which tier it’s in and what your cost will be - copay, coinsurance, or deductible. Don’t rely on summaries or phone reps. Always check the official list.

Can my generic drug suddenly become more expensive after I switch plans?

Yes. Every January, insurers update their formularies. A drug that was Tier 1 last year could move to Tier 2, or the manufacturer might change. Even if it’s still labeled "generic," if it’s not the exact brand the plan prefers, your copay can jump from $5 to $40. Always verify your drugs during open enrollment.

Are all generic drugs the same? Why does the manufacturer matter?

Legally, yes - they have the same active ingredient. But insurers often prefer generics from certain manufacturers because they negotiate lower prices. If your plan lists "metformin (Teva)" as Tier 1 but not "metformin (Mylan)," switching to the Mylan version means you’re now on Tier 2. You’re still getting the same medicine, but you pay more.

Should I use a mail-order pharmacy for my generics?

Often, yes. Most plans offer a discount for 90-day mail-order supplies - sometimes as low as $10 for a 3-month supply. But only if the pharmacy is in-network. Check your plan’s list of approved mail-order pharmacies. Using a non-preferred one could cost you 3-4 times more.

What if my drug isn’t covered at all?

You can request a formulary exception. Contact the insurer and ask for a coverage appeal. You’ll need a letter from your doctor explaining why you need that specific drug - maybe you had side effects with others. If approved, they’ll cover it at a lower tier. Don’t assume it’s impossible - many exceptions are granted.

Is it worth switching plans just for better generic coverage?

If you take even one regular medication, absolutely. A plan with a $3 generic copay can save you $780 a year compared to one with a $15 copay. Add in a deductible waiver for generics, and you’re talking $1,000+ in savings. That’s more than most people save by lowering their monthly premium. Focus on drug costs - not just premiums.

Ayush Pareek

January 15, 2026 AT 22:23Just switched plans last year and nearly got burned because my metformin switched from Teva to Mylan. Thought it was the same pill-turns out the new one wasn't preferred. Ended up paying $35 instead of $5. Learned the hard way: always check the manufacturer, not just the drug name.

Pro tip: Use GoodRx to compare cash prices too. Sometimes it’s cheaper than your copay, even with insurance.

RUTH DE OLIVEIRA ALVES

January 16, 2026 AT 07:37It is imperative to note that the structural disparities in formulary design across health insurance plans are not merely administrative nuances-they represent significant financial risk to individuals reliant on chronic medication regimens.

Furthermore, the absence of standardized nomenclature regarding generic drug tiers across state jurisdictions creates a regulatory patchwork that undermines equitable access to affordable pharmaceuticals. This fragmentation necessitates proactive, individualized due diligence during plan selection, as reliance on aggregated summaries or third-party tools is inherently unreliable.

Crystel Ann

January 17, 2026 AT 15:17I didn’t realize my thyroid med was going to jump from $0 to $25 until I got to the pharmacy. Just checked my new plan’s formulary last week-thank god I did. So many people don’t even know this is a thing. Please, if you take any meds, take 20 minutes before open enrollment. It’s worth it.

Nat Young

January 18, 2026 AT 03:54Everyone’s acting like this is some big secret. Nah. Insurance companies *want* you to miss this. They make the formularies confusing on purpose. That’s how they profit. You think they care about your thyroid? No. They care about your premium. And if you don’t read the fine print, you’re just handing them money.

And don’t even get me started on Medicare Advantage. Those plans are designed to look cheap until you need something real. Then they hit you with a 40% coinsurance on your $200 med. Classic bait-and-switch.

Sohan Jindal

January 18, 2026 AT 09:01This is why America is broken. You can’t even get your medicine without a PhD in insurance jargon. The government lets these companies rip people off. My cousin had to pay $800 for insulin last year because his plan didn’t cover the right brand. He’s not rich. He’s just a working guy trying to stay alive.

They need to ban this crap. No more tiers. No more manufacturer tricks. Just cover the drugs. Simple.

Frank Geurts

January 18, 2026 AT 18:39While I commend the author for the comprehensive and meticulously structured exposition on formulary dynamics, I must emphasize the critical importance of verifying not only the drug’s tier classification, but also the precise nomenclature used by the insurer-particularly regarding proprietary naming conventions, which may differ from the FDA-approved generic designation.

Additionally, one must cross-reference the plan’s network pharmacy roster with the preferred mail-order provider, as discrepancies therein can result in catastrophic cost differentials, even when the drug itself is technically covered.

As a former claims analyst, I can attest that over 78% of medication-related appeals stem from incomplete pre-enrollment verification-not from actual coverage denials.

Arjun Seth

January 19, 2026 AT 01:20You people are too soft. You’re checking formularies like it’s some kind of chore. It’s not. It’s survival. If you don’t know your drug’s manufacturer, tier, and copay before you sign up-you’re asking to get robbed.

I’ve seen guys lose their jobs, their homes, because they trusted their HR rep. HR doesn’t care. They’re paid to sell plans, not save lives. You think the system’s broken? No. It’s working exactly how they designed it.

Mike Berrange

January 20, 2026 AT 07:25So you’re telling me I have to spend hours digging through PDFs just to get my blood pressure pills? And if I miss one letter in the manufacturer name, I pay $50 extra?

This isn’t healthcare. This is a rigged game. I’m done playing. I’m going cash-only. GoodRx says my metformin is $4. I’ll take that over your 3-tier nightmare any day.

Dan Mack

January 20, 2026 AT 17:00They’re hiding the truth. You think this is about savings? Nah. It’s about control. They want you scared. They want you confused. They want you thinking you need them.

And that’s why they’re pushing mail-order. So they can track your meds. So they can sell your data. So they can raise your rates next year because ‘you’re high risk’.

They’re not saving you money. They’re building a profile. And you’re giving it to them for free.