Getting the medicine you need shouldn’t mean choosing between rent and refills. Every year, millions of Americans turn to patient assistance programs from drug companies to get life-saving prescriptions at no cost or low cost. But eligibility isn’t simple. It’s a maze of income limits, insurance rules, and paperwork that can leave even well-informed patients stuck.

Who Qualifies for Drug Company Patient Assistance Programs?

The core rule across nearly every program is income. Most require your household income to be at or below 500% of the Federal Poverty Level (FPL). For 2023, that means $75,000 a year for a single person and $153,000 for a family of four. But here’s where it gets tricky: some programs set the bar lower. Pfizer’s RxPathways, for example, uses 300% FPL ($43,200 for one person) for common medications like Eucrisa, but raises it to 600% FPL ($77,760) for cancer drugs. That’s because specialty medications cost far more - and companies know patients can’t pay out of pocket.Insurance Status: The Biggest Hurdle

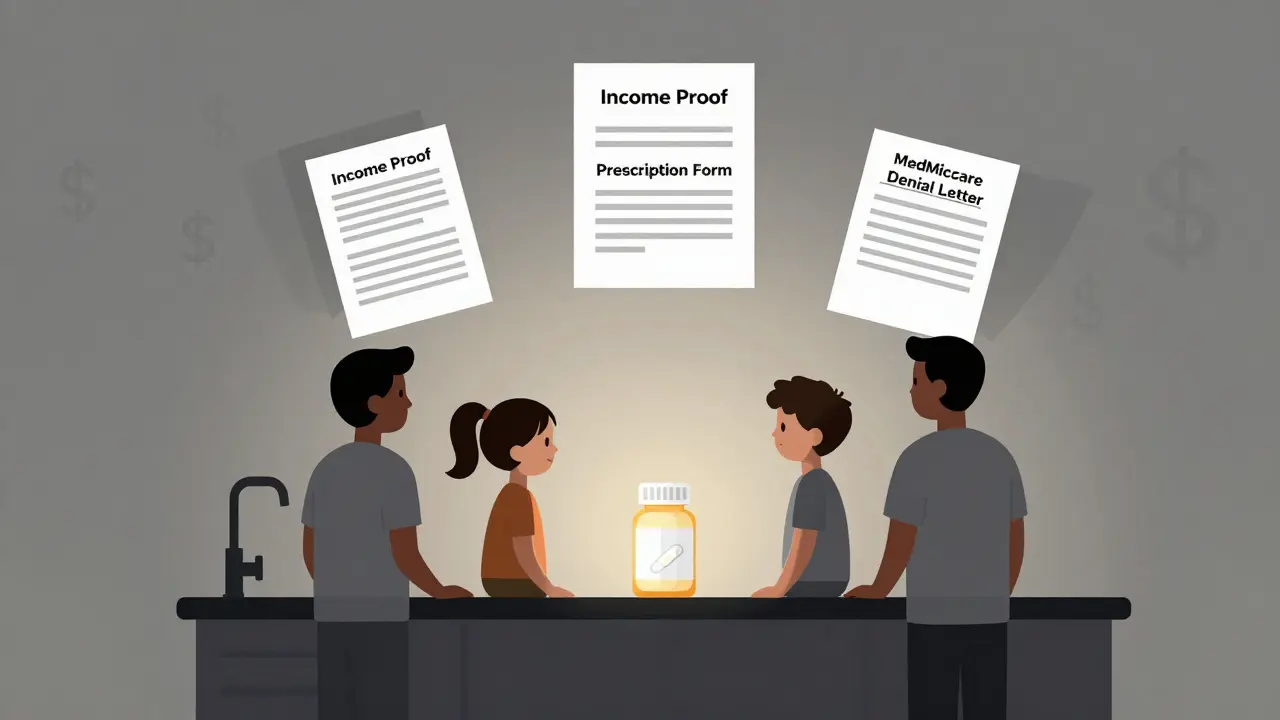

If you have private insurance, you might be automatically disqualified. That’s right. Most manufacturer programs only help people who are uninsured or on government programs like Medicaid. GSK’s Patient Assistance Foundation won’t help someone with commercial insurance, even if their deductible is $10,000. Meanwhile, Merck makes exceptions for insured patients only if they prove extreme financial hardship - and even then, they must show their insurance doesn’t cover the drug. Medicare beneficiaries face another layer of complexity. If you’re on Medicare Part D, you can’t just apply for a drug company’s PAP. First, you must apply for Medicare’s Extra Help program. If you’re denied - and many are - then you can try the manufacturer’s program. Takeda’s Help At Hand program requires you to submit proof of that denial. If your income is between 135% and 150% FPL ($18,347-$20,385 for one person), you fall into a dangerous gap: you earn too much for Extra Help but too little to afford your co-pays. That’s where many patients get stuck.What Documents Do You Need?

You won’t just fill out a form and get approved. Every program demands proof. You’ll need:- Proof of income: W-2s, pay stubs, or your last tax return

- Proof of residency: utility bill, lease, or driver’s license

- Proof of prescription: a signed form from your doctor

- Proof of identity: government-issued ID

How Do Major Companies Compare?

Not all programs are built the same. Here’s how a few big names stack up:| Company | Max Income (Single Person) | Insurance Requirement | Medicare Part D Rules | Re-enrollment Needed |

|---|---|---|---|---|

| Pfizer (RxPathways) | $77,760 (600% FPL for oncology) | Uninsured or underinsured only | Must apply for Extra Help first | Annually for primary care; quarterly for specialty |

| GSK Patient Assistance Foundation | $58,650 (400% FPL) | Uninsured only | Not available to Medicare Part D beneficiaries | Every 12 months |

| Merck | $75,000 (500% FPL) | Uninsured or hardship exception | Requires Extra Help denial | Annually |

| AbbVie | Medication-specific (up to 500% FPL) | Uninsured or underinsured | Must select drug first, then check eligibility | Every 12 months |

| Takeda (Help At Hand) | $20,385 (150% FPL for Medicare patients) | Medicare Part D only | Requires Extra Help denial | Every 12 months |

Why Are So Many Applications Denied?

A 2022 survey by the Medicare Rights Center found that 37% of initial applications were denied. The top reasons? Incomplete paperwork (68%) and income verification issues (22%). Many people think their tax return is enough - but if you’re self-employed or get paid in cash, you need additional proof like bank statements or client letters. Others don’t realize their household size matters. If you live with an adult child who earns $40,000, that income counts - even if they don’t help pay for your meds. Another hidden trap: some insurance plans actually tell patients to apply for PAPs to reduce their own costs. That’s a violation. Companies like Merck explicitly say they won’t help if your insurer is pushing you toward their program. It’s designed to protect the company from liability, but it leaves patients confused.What If You Don’t Qualify?

If you’re turned down by a drug company’s program, don’t give up. Independent charities like the PAN Foundation and HealthWell Foundation often have more flexible rules. They cover people with insurance if their out-of-pocket costs are too high. But they also have lower income caps - usually 400% FPL - and limited funds. Waiting lists are common. You can also ask your doctor about samples. Many offices still keep small quantities of expensive drugs to give patients short-term relief. Pharmacists can help too - some pharmacies partner with PAP navigators who can walk you through applications.

What’s Changing in 2025 and Beyond?

The Inflation Reduction Act is changing the game. Starting in 2025, Medicare Part D beneficiaries will pay no more than $2,000 a year out of pocket for prescriptions. That’s a huge shift. Experts predict this will cut PAP use among Medicare patients by 35-40%. But it won’t help the 27.5 million Americans who are underinsured - meaning they have coverage but still can’t afford co-pays. Drug companies are already adapting. Twelve major manufacturers launched new “commercial PAPs” in 2022-2023 that help insured patients with high deductibles. Pfizer’s RxPathways now links directly to TurboTax, cutting application errors by nearly 30%. These changes are good, but they’re still patchwork solutions.How to Apply Successfully

If you’re ready to apply, follow these steps:- Find your drug’s manufacturer website. Search “[Drug Name] patient assistance program.”

- Use the Medicine Assistance Tool (MAT) from NeedyMeds.org - it pulls up all available programs for your medication.

- Calculate your Modified Adjusted Gross Income (MAGI) using IRS guidelines. Don’t guess.

- Call your doctor’s office. Ask them to complete the form - and follow up in a week.

- Submit everything at once. Missing one document means starting over.

- Reapply every year. Most programs require annual recertification.

Final Reality Check

Patient assistance programs save lives. In 2021, drug companies distributed over $20 billion in free medications. But they’re not a fix for broken healthcare. They’re a band-aid on a system where one pill can cost $10,000 a month. The programs work - if you can navigate them. The real problem isn’t your paperwork. It’s that we’ve made access to medicine depend on charity instead of policy.If you’re struggling, start today. Don’t wait until your prescription runs out. Reach out. Call the program. Ask for help. You’re not alone - and you deserve to get the medicine you need.

Can I get free medicine if I have Medicare?

Yes, but only under specific conditions. Most drug company programs require you to first apply for Medicare’s Extra Help program. If you’re denied Extra Help due to income or other reasons, you may then qualify for a manufacturer’s PAP. Programs like Takeda’s Help At Hand and Merck’s are designed for this scenario. However, if your income is above 150% of the Federal Poverty Level, you likely won’t qualify for either.

Do I need to be completely uninsured to qualify?

Most manufacturer programs require you to be uninsured or underinsured - meaning your insurance doesn’t cover the drug or your out-of-pocket costs are unaffordable. Some, like Merck, make exceptions for insured patients who can prove extreme financial hardship. But if your insurance plan requires you to apply for the PAP to reduce their costs, you’ll be turned down. Private insurers are not allowed to push patients toward these programs - and manufacturers won’t help if they think you’re being used as a cost-saving tool.

How long does it take to get approved?

Approval usually takes 7-14 days if your paperwork is complete. Some programs, like Pfizer’s, can approve you in under 72 hours once all documents are submitted. But if you’re missing a form or income verification, the process can drag on for weeks. Many applicants report having to submit 3-5 versions before getting approved. Don’t be discouraged - persistence pays off.

Can I apply for multiple programs at once?

Yes. You can apply to multiple drug company programs if you’re taking several medications. You can also apply to independent charities like PAN Foundation or HealthWell Foundation at the same time. Just make sure you don’t double-dip - you can’t use two programs to cover the same drug. Each program requires you to declare what other assistance you’re receiving.

What if my income changes after I’m approved?

You must report changes. Most programs require annual recertification, but some - especially for specialty drugs - ask for updates every 3 months. If your income goes above the limit, your benefits may stop. If your income drops, you might qualify for more help. Always update your information. Falling behind on reporting can lead to sudden loss of medication.

Are there programs for people who are underinsured?

Yes - but not from drug manufacturers. Most manufacturer PAPs don’t help people with insurance. However, independent charities like the PAN Foundation and HealthWell Foundation specialize in helping underinsured patients. They cover co-pays and deductibles for people whose insurance doesn’t fully cover their drugs. Income limits still apply, but they’re more flexible than manufacturer programs.

Arlene Mathison

January 20, 2026 AT 02:52Just applied for my mom’s diabetes med through RxPathways - took three tries, but we got it! Docs are swamped, so I had to call their office every 3 days until they signed the form. Worth it. She’s been refilling for 6 months now with zero cost. If you’re struggling, don’t give up. You’re not alone.

Emily Leigh

January 21, 2026 AT 05:05So… we’re just supposed to rely on Big Pharma’s mercy now? 😒 Like, wow. What a system. The real solution is universal healthcare, not begging for scraps from corporations who made $100B last year off these same drugs. But hey, at least they’re *kind* enough to let us fill out 17 forms before they ‘choose’ to help. 🙃

Carolyn Rose Meszaros

January 21, 2026 AT 06:43OMG this post is SO helpful!! 🙌 I’ve been googling this for weeks and didn’t even know about MAT from NeedyMeds. Just applied for my husband’s cancer med - fingers crossed! Also, the part about MAGI vs gross income? LIFE SAVER. I was using the wrong numbers 😅

Greg Robertson

January 23, 2026 AT 03:26Thanks for putting this together - really clear breakdown. I’m a pharmacist and see this every day. The hardest part isn’t the paperwork, it’s the emotional toll on patients. They’re exhausted just trying to survive. If you’re reading this and feel overwhelmed, reach out to a local community health center. They’ve got navigators who’ll walk you through it. You’ve got this.

Renee Stringer

January 24, 2026 AT 01:05People who apply for these programs are often irresponsible with their finances. If you can’t afford your meds, maybe you shouldn’t have bought that new phone, or eaten out so much, or taken that vacation. These programs aren’t entitlements - they’re charity. And charity shouldn’t be a right.

Crystal August

January 25, 2026 AT 12:44STOP. Just stop. You think this is about ‘access’? It’s about control. These programs exist so drug companies can avoid price regulation. They let you apply for free meds while keeping the list price at $12,000/month. They’re not helping you - they’re hiding behind ‘charity’ to avoid accountability. The system is rigged, and you’re being played.

Nadia Watson

January 26, 2026 AT 10:11Thank you for this comprehensive guide - it is truly invaluable. I am a case manager in a rural clinic, and I have seen firsthand how these programs can mean the difference between life and death. Many patients, especially elderly or non-English-speaking individuals, are unaware of the existence of these resources. I encourage all healthcare providers to proactively discuss PAPs during visits, even if only to provide a printed resource. The complexity of the process is not the fault of the patient - it is the failure of the system. Let us not confuse compassion with compliance.

Courtney Carra

January 27, 2026 AT 02:54It’s wild how we’ve turned medicine into a lottery. You win if you’re lucky enough to have a doctor who has time, if you know the right acronyms, if you don’t mess up your MAGI, and if the company feels like it today. We’re not fixing healthcare - we’re just teaching people how to play the game better. And the game was designed to be unwinnable for most.