Medicare Part D isn’t just a drug benefit-it’s a massive economic engine built on one simple idea: generics save money. Since it launched in 2006, the program has filled over 12 billion prescriptions, and nearly 9 out of every 10 of those were for generic drugs. That’s not by accident. It’s by design. The entire structure of Part D is built to push beneficiaries toward cheaper, equally effective alternatives to brand-name medications. And it works-spectacularly well.

How Part D’s Tiered System Pushes Generics

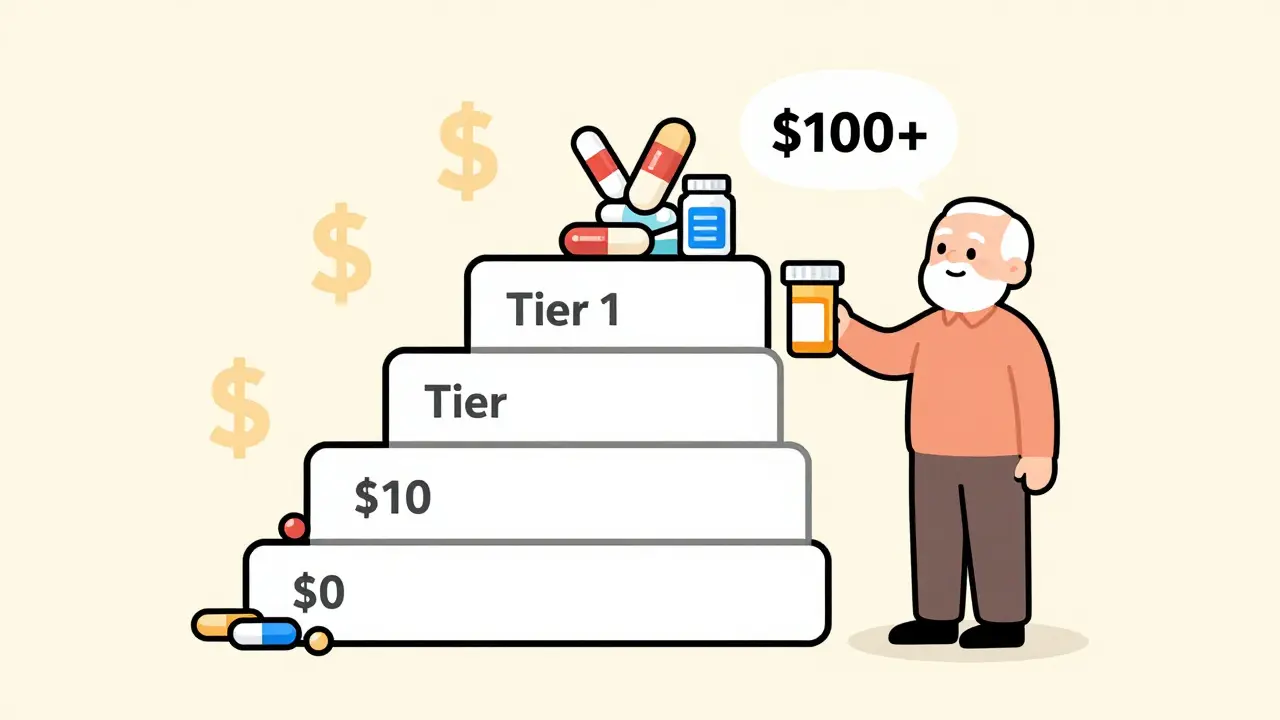

Every Medicare Part D plan uses a tiered formulary, like a pricing ladder for drugs. The lowest rung? Tier 1: Preferred Generics. These are the cheapest drugs you can get-often $0 to $10 for a 30-day supply at a preferred pharmacy. Tier 2 is regular generics, usually around $15. Then come Tier 3 brand-name drugs ($45-$75), Tier 4 specialty drugs ($100+), and Tier 5 high-cost specialty meds that can cost hundreds. The math is clear: if you take a blood pressure pill like amlodipine, the generic version costs $0. The brand name, Norvasc, costs $45. That’s $540 a year in savings-just for one drug. Multiply that across the average beneficiary taking three or four prescriptions, and you’re talking $1,500-$2,500 saved annually. The system doesn’t just rely on low copays. It also uses coinsurance. During the initial coverage phase, you pay 25% of the drug’s price. For a $20 generic, that’s $5. For a $150 brand-name drug, that’s $37.50. The gap between what you pay for generics versus brands grows wider the more you spend. And when you hit catastrophic coverage-after $2,000 out of pocket in 2025-you pay either 5% of the cost or a tiny flat fee: $4.15 for generics, $10.35 for brands. The system is stacked to reward generic use at every stage.Why Generics Dominate Part D Prescriptions

In 2023, 87.3% of all Part D prescriptions were for generics. That’s up from 60% when the program started. Why the jump? Because the economics make no sense to use brand names unless you have to. Part D plans don’t just encourage generics-they require them. CMS mandates that every plan must include at least two generic drugs in each of 148 common therapeutic categories. For most conditions-high cholesterol, diabetes, depression, arthritis-there are multiple generic options. And plans know this: the more generics they include, the lower their overall drug costs, which means they can offer lower premiums and better benefits to attract enrollees. The savings aren’t just for beneficiaries-they’re for the whole program. In 2023, Part D spent $198.4 billion total. Generics made up only 24.1% of that spending, even though they accounted for 87.3% of prescriptions. Brand-name drugs, at just 12.7% of prescriptions, consumed 75.9% of the budget. That’s the power of scale and price control. A single generic prescription costs Part D plans about $18.75 on average. A brand-name? $156.42. That’s an 88% cost difference.Who Benefits the Most?

The biggest winners are low- and middle-income seniors. A 2023 Kaiser Family Foundation analysis found that beneficiaries using Tier 1 generics saved an average of $1,560 to $2,340 per year per medication compared to brand names. For someone living on a fixed income, that’s rent, groceries, or heating bills. But it’s not perfect. A September 2023 KFF report found that 32.1% of low-income beneficiaries still skip doses-even when generics are available-because they’re afraid of the next bill. Some plans still put high-cost generics (like those for autoimmune diseases) in Tier 3 or 4, making them unaffordable. And not all manufacturers accept coupons or discounts through Part D, so sometimes the brand-name drug ends up cheaper than the generic due to outside promotions. One Reddit user, u/MedicareUser87, summed it up: “My blood pressure med is $0 for the generic. The brand is $45. I don’t even think about the brand anymore.” But another user, u/RetiredPharmacist, warned: “I’ve seen cases where the brand costs less than the generic because the coupon isn’t accepted.” That’s a trap. It’s why you can’t just assume generics are always cheaper-you have to check your plan’s formulary.

Plan Differences Matter-A Lot

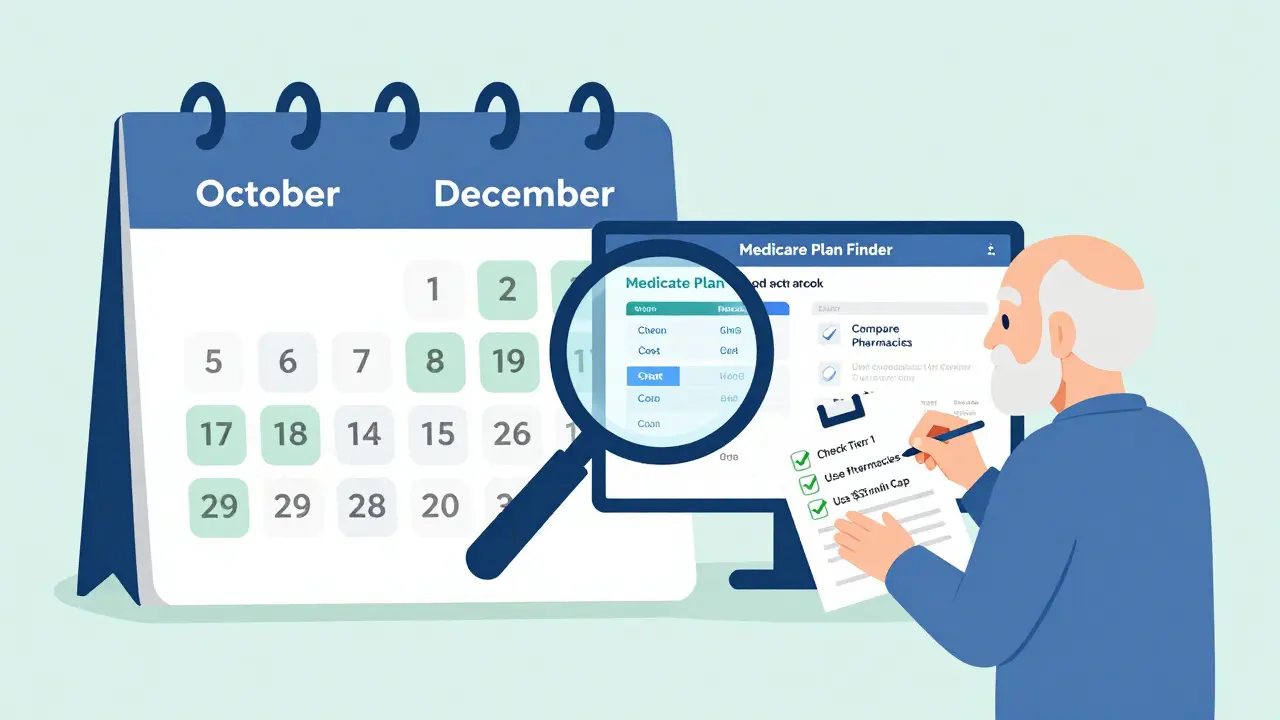

Not all Part D plans are created equal. Standalone Prescription Drug Plans (PDPs) tend to cover 92.4% of generic drugs. Medicare Advantage plans with drug coverage (MA-PD) cover 89.7%. That 2.7% gap might seem small, but it can mean the difference between a $0 copay and a $25 one. And formularies change. In 2023, CMS recorded that 18.7% of beneficiary complaints were about generics being moved to higher tiers mid-year. One person’s $0 drug in January becomes a $15 drug in June. That’s why annual enrollment (October 15 to December 7) isn’t optional-it’s critical. If you don’t review your plan, you might wake up next year paying $600 more. The Medicare Plan Finder tool is your best friend. People who use it save an average of $427 a year, according to a 2023 Urban Institute study. You can filter by drug, pharmacy, and copay. You can compare plans side by side. You can even see if your pharmacy is preferred. It takes three to five hours of research-but it’s worth it.The New Rules: Caps, Discounts, and More Generics

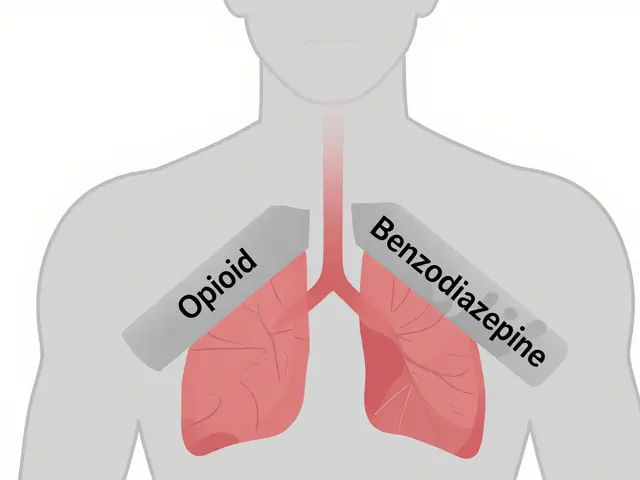

In 2025, everything changed. The Inflation Reduction Act introduced two major shifts: a $2,000 annual cap on out-of-pocket drug costs and a $35 monthly cap on insulin. These caps make it safer to use high-cost generics, especially for people with chronic conditions like rheumatoid arthritis or multiple sclerosis. Before, someone might delay refilling a $200 generic because they were close to the old $7,000 out-of-pocket limit. Now, they can take it without fear. Also starting January 1, 2025, drug manufacturers must give Part D plans additional discounts on both brand-name and generic drugs during the initial coverage and catastrophic phases. This “Manufacturer Discount Program” is expected to push generic use to 91.5% by 2027. The Congressional Budget Office estimates this will save the federal government $14.2 billion a year. CMS also issued a new rule in 2024: every therapeutic category must include at least one generic drug with no prior authorization. That means no more delays for your generic thyroid med or diabetes pill. You can walk in, get it filled, and go.

What You Can Do Right Now

If you’re on Medicare Part D, here’s what to do:- Log into Medicare.gov’s Plan Finder and enter your drugs. Look for plans with $0 copays on Tier 1 generics at your pharmacy.

- Check if your current generic is still in Tier 1. If it moved up, consider switching during open enrollment.

- Ask your pharmacist: “Is this the preferred generic?” Some pharmacies automatically substitute, but not always the cheapest one.

- If a generic makes you sick or doesn’t work, request a “coverage determination.” CMS approves these 78.4% of the time.

- Don’t skip doses because of cost. Use the $35 insulin cap. Use the $2,000 out-of-pocket cap. They’re there to protect you.

Ian Long

January 8, 2026 AT 06:57Man, I just switched my blood pressure med to the generic last month and my copay went from $45 to $0. I thought I was dreaming. I even told my wife I should start a YouTube channel called 'How I Saved $500 on Pills'-she laughed so hard she spilled her coffee.

Turns out, I didn’t even need to call my doctor. The pharmacist just swapped it out automatically. No drama. No paperwork. Just pure, beautiful savings.

Now I’m checking all my meds. Turns out my cholesterol pill? Also $0. My diabetes med? $5. I feel like I won the lottery without buying a ticket.

Matthew Maxwell

January 9, 2026 AT 00:03It is imperative to note that the apparent economic efficiency of generic drugs is predicated upon a flawed assumption: that bioequivalence guarantees therapeutic equivalence. The FDA’s standards for generics are woefully inadequate, and numerous peer-reviewed studies have demonstrated clinically significant variations in absorption rates, excipient composition, and dissolution profiles.

Furthermore, the consolidation of generic manufacturers into a triopoly-Teva, Mylan, Sandoz-creates a de facto cartel that manipulates supply chains to artificially inflate prices on certain niche generics, particularly those with limited production capacity. This is not free-market economics-it is regulatory capture masquerading as cost containment.

Lindsey Wellmann

January 9, 2026 AT 17:06OMG I JUST REALIZED MY THERAPY MED IS NOW $0 😭😭😭 I’VE BEEN PAYING $75 FOR YEARS AND I DIDN’T EVEN KNOW I COULD SWITCH?!

Also-why is no one talking about how the $35 insulin cap is literally saving lives?? I have a friend who was choosing between insulin and her cat’s food. Now she’s got both. 🐱❤️💊

Also also-can we talk about how the Plan Finder tool is the unsung hero of Medicare? I spent 3 hours on it. It was like Tinder for pills. Swipe right on $0 copays. Swipe left on drama.

Ashley Kronenwetter

January 11, 2026 AT 15:39While the cost savings associated with generic drug utilization are substantial, it is equally important to acknowledge the systemic inequities that persist within the Part D structure. The discretionary tiering of generics, particularly for high-cost specialty agents, disproportionately impacts rural and low-income beneficiaries who lack access to pharmacy counseling or digital literacy tools.

Moreover, the absence of standardized formulary transparency across Medicare Advantage plans creates a fragmented landscape where beneficiaries are left to navigate opaque, frequently changing formularies without adequate support.

Policy interventions must prioritize equitable access, not merely cost reduction.

Aron Veldhuizen

January 13, 2026 AT 13:28You all are missing the philosophical core of this issue. Generics aren’t about savings-they’re about surrender. We’ve conditioned ourselves to accept the lowest common denominator in medicine because we’ve been taught that health is a commodity, not a right.

When I take a generic, I’m not just saving $45-I’m signing a silent contract with a system that tells me my body isn’t worth the original formulation. That’s not economics. That’s existential resignation.

And yet, I still take it. Because the system won’t let me choose otherwise. So who’s really the villain here? The manufacturer? The government? Or us-for not fighting harder?

Heather Wilson

January 14, 2026 AT 21:49Let’s be real: 87% generics? That’s not a win. That’s a failure of innovation. If you’re relying on generics for 9 out of 10 prescriptions, it means the pharmaceutical industry has given up on developing better drugs. Why bother inventing a new statin when you can just repurpose a 40-year-old molecule and sell it for $18?

And don’t even get me started on the ‘$0 copay’ myth. That’s only if your pharmacy is in-network, your plan hasn’t changed the tier, and you didn’t miss the 3-week window to appeal the formulary change.

It’s a house of cards. And the people paying the price? The elderly who can’t afford to be wrong.

Micheal Murdoch

January 16, 2026 AT 07:14Hey everyone-just want to say this is one of the clearest, most useful breakdowns of Part D I’ve ever read. Seriously.

For those who are overwhelmed by the Plan Finder tool: start with just one drug. Enter your name, your dose, and your pharmacy. Don’t try to compare 10 plans at once. Pick the one with the lowest copay for your top med. Then check next month.

And if you’re on a fixed income? Talk to your pharmacist. They know more than your doctor sometimes. I’ve had pharmacists tell me, ‘Skip the brand, go with this one-it’s the same pill, just cheaper.’

You’re not alone in this. There are people who want you to succeed. Just ask.

Jeffrey Hu

January 17, 2026 AT 02:12Wait-so you’re telling me I’ve been paying $45 for amlodipine for 8 years and the generic is $0? That’s insane. I didn’t even know the brand name was Norvasc. I just asked for ‘the blue pill.’

Also, I just checked my plan and my diabetes med is Tier 2. $15. But I saw on Reddit that someone else got it for $0. How? Did they lie? Did they hack the system? What’s the secret?

Also, can I get a coupon for my generic? Or is that illegal now? I’m confused. Someone explain this like I’m 70 and just got a smartphone.

Drew Pearlman

January 17, 2026 AT 03:31I just want to say thank you to whoever wrote this. I’m 72, retired, and I’ve been terrified of my drug bills since 2020. I thought I had to choose between food and meds.

After reading this, I spent two hours on Medicare.gov. Found a plan that drops my generic arthritis med from $20 to $0. Saved $240 this year already.

And guess what? I didn’t die from the process. I didn’t cry. I didn’t scream into the void.

I just did it. And now I feel like I can breathe again.

You don’t have to be an expert. You just have to start. One step. One pill. One plan. You got this.