When your doctor prescribes a medication and your insurance says no, it’s not just frustrating-it can be dangerous. You’re not alone. In 2024, prior authorization denials blocked access to over 18 million prescriptions in the U.S. But here’s the thing: 82% of those denials get reversed when you appeal. That means if you’ve been told no, you’ve probably been told wrong. And the fix isn’t as complicated as your insurer wants you to think.

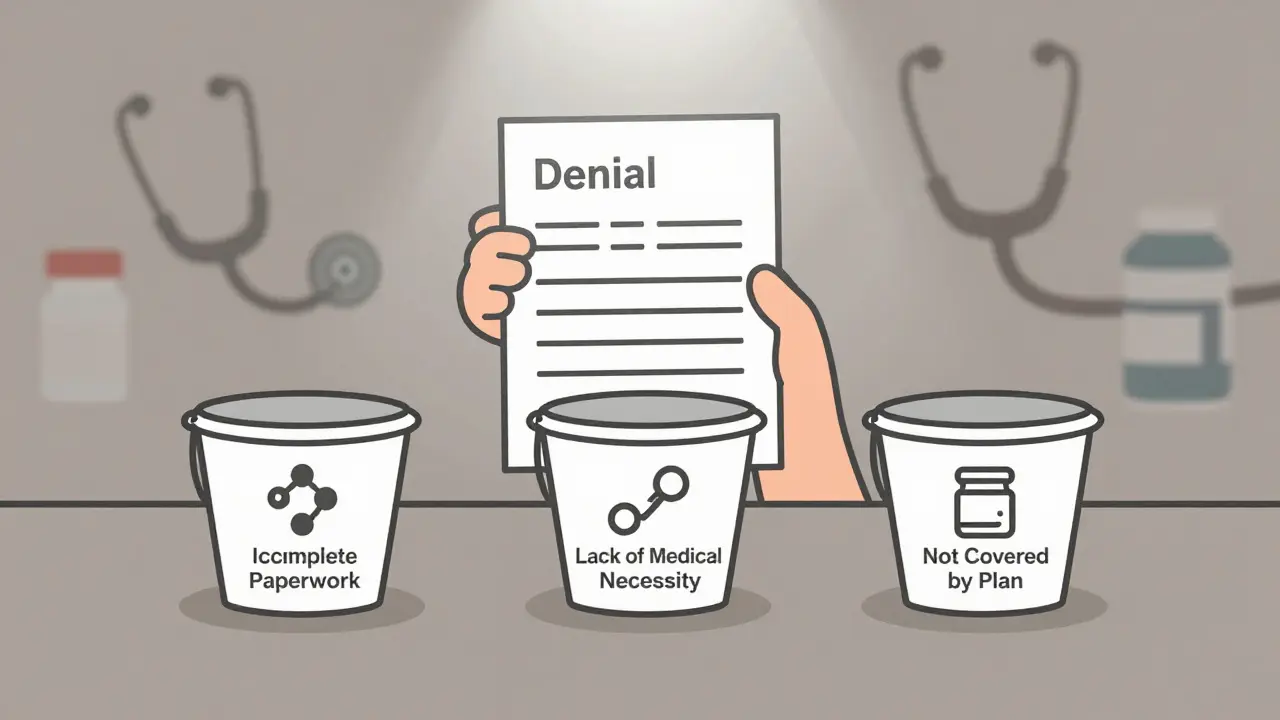

Understand Why Your Medication Was Denied

The denial letter from your insurance company is your first clue. Don’t ignore it. Don’t toss it. Read it like a detective. Denials usually fall into three buckets:- Incomplete paperwork (37% of cases): Missing forms, wrong IDs, or a fax that never went through.

- Lack of medical necessity (48%): The insurer claims your condition doesn’t justify the drug, even if your doctor says otherwise.

- Not covered by plan (15%): The drug isn’t on their formulary, or they want you to try cheaper alternatives first.

Gather Every Document You Need

Your appeal isn’t a letter. It’s a case file. You need proof. Start with:- Your official denial letter (the EOB form)

- Full medical records from your doctor, including diagnosis codes (ICD-10) and procedure codes (CPT)

- Lab results, imaging reports, or specialist notes showing why this drug is needed

- A letter from your prescribing physician explaining why alternatives failed

Know Your Insurer’s Rules

Every insurer has its own process. You can’t wing it. CVS/Caremark requires appeals to be faxed to 1-888-836-0730 and includes your full name, member ID, date of birth, drug name, and physician’s clinical statement. UnitedHealthcare demands online submissions through their provider portal. Medicare Advantage plans often let you appeal by phone. Check your plan’s website or call their member services and ask: “What’s the exact process and deadline for a prior authorization appeal?” Time matters. You typically have 180 days from the denial date to file. But don’t wait. Most insurers give you 30 days to respond before they consider the case closed. If you’re unsure, call them every week. One physician survey found 78% of people had to follow up multiple times just to get someone to look at their appeal.Write a Strong Appeal Letter

Your letter isn’t a request. It’s a rebuttal. Address each reason for denial directly. Use the insurer’s own language. If they say “medical necessity not met,” respond with: “Per your plan’s clinical policy on [drug name], medical necessity is established by [ICD-10 code] and documented treatment failure of [alternative drug].” Include these five things:- Your full name, member ID, and date of birth

- The exact drug name and NDC number

- Why the denial is incorrect, point by point

- Clinical evidence: test results, prior treatment failures, specialist opinions

- A clear request: “I request immediate approval of [drug name] under my plan benefits.”

Get Your Doctor Involved

Your doctor isn’t just a name on the form-they’re your strongest ally. Many don’t realize they can call the insurer’s medical review team directly. Ask them to do it. Tell them: “I’m appealing. Can you call the insurance company and explain why this drug is medically necessary?” Doctors who do this see results. One endocrinologist in Arizona reported that after she started calling insurers herself, approval rates jumped from 45% to 85%. Insurers listen to clinicians-not patients. Your doctor can cite guidelines, reference studies, and explain why step therapy failed. If they refuse, ask for a written statement. If they still won’t help, find another provider who will.Track Everything

Keep a log. Write down:- Date you submitted the appeal

- Who you spoke with (name, ID, time)

- What they said

- Next follow-up date

What If You’re Still Denied?

If you’ve done everything right and still got a no, you have options:- External review: Request one through your insurer. They must send you the form. An independent doctor reviews your case. This is your last shot inside the system.

- Medicare Advantage: If you’re on Medicare, appeal rates are 22% higher than commercial plans. Use that to your advantage.

- Financial assistance: Many drug manufacturers offer patient assistance programs. For example, AbbVie (Humira’s maker) has a program that can cover the full cost if you qualify.

- Legal aid: Some states have patient advocacy offices that help with appeals. Call your state’s insurance commissioner.

Real Stories, Real Results

One patient in Ohio was denied Ozempic for type 2 diabetes because the insurer said she hadn’t tried metformin long enough. She provided records showing she’d been on metformin for 14 months with no improvement. Her doctor called the insurer. Approval came in five days. Another in Texas was denied a specialty infusion drug for multiple sclerosis. The denial letter didn’t mention any clinical criteria. He appealed with his full medical history, including three failed oral meds. He included a letter from his neurologist citing the 2023 AAN guidelines. Approved within 10 days. These aren’t rare. They’re normal. The system is broken, but it’s not unbeatable.What to Avoid

Don’t:- Wait until your prescription runs out

- Send handwritten letters

- Use vague phrases like “my doctor says it’s needed”

- Forget to include your member ID

- Assume your doctor will handle it

Why This Matters

Prior authorization isn’t just bureaucracy. It’s a barrier to care. In 2023, 79% of physicians said patients abandoned treatment because of delays. People skip doses. They stop taking meds. They end up in the ER. That’s why appeals aren’t just paperwork-they’re life-saving. The system is designed to say no. But you have the right to say yes. And with the right documents, the right timing, and the right voice, you can win.What if I don’t have a copy of the denial letter?

Call your insurance company’s member services and ask for a copy of the Explanation of Benefits (EOB) that shows the denial. If you’re on a self-insured plan through your employer, contact your HR department. You’re legally entitled to this document. Without it, you can’t appeal.

How long does an appeal take?

Most insurers have 30 days to respond to a standard appeal. If you’re on Medicare Advantage, they must respond within 72 hours under 2024 CMS rules. For urgent cases-like if you’re running out of medication-you can request an expedited review. That cuts the timeline to 72 hours or less.

Can I appeal if I’m on Medicare?

Yes. Medicare Advantage plans must follow federal appeal rules. In fact, they have higher approval rates than commercial insurers-22% higher in 2024. The process is similar: get the denial letter, gather medical records, submit your appeal, and follow up. You can also request an external review if needed.

Do I need a lawyer to appeal?

No. Most appeals are handled successfully by patients and doctors without legal help. But if your case involves a large sum, a life-threatening condition, or multiple denials, a patient advocate or legal aid organization can help. Many states offer free advocacy services through their insurance commissioner’s office.

What if my doctor won’t help me appeal?

Ask them why. Some doctors are overwhelmed by paperwork. Others don’t know how. Request a written statement explaining why the drug is medically necessary. If they still refuse, consider switching to a provider who prioritizes patient access. Your health matters more than loyalty to one office.

Are there free resources to help me appeal?

Yes. The Patient Advocate Foundation, the National Organization for Rare Disorders, and your state’s insurance commissioner all offer free appeal guides and support. The Obesity Action Coalition and American Medical Association also have templates and step-by-step checklists online. Use them.

Next Steps

Start today. Get your denial letter. Call your doctor. Write your letter. Send it. Follow up. Don’t wait for someone else to fix this. You’re the only one who can.If you’ve been denied, you’re not alone. And you’re not powerless. The system is stacked against you-but you’ve got the tools to win.

Julie Chavassieux

December 21, 2025 AT 19:49Tarun Sharma

December 22, 2025 AT 12:17Jim Brown

December 22, 2025 AT 15:34Cara Hritz

December 24, 2025 AT 07:41Jamison Kissh

December 24, 2025 AT 11:43Jeremy Hendriks

December 24, 2025 AT 12:06Ajay Brahmandam

December 25, 2025 AT 19:28jenny guachamboza

December 26, 2025 AT 05:48Gabriella da Silva Mendes

December 26, 2025 AT 11:03Johnnie R. Bailey

December 27, 2025 AT 21:34Nader Bsyouni

December 29, 2025 AT 09:03Vikrant Sura

December 30, 2025 AT 02:10Candy Cotton

December 31, 2025 AT 10:55